Getting a safety deposit box starts with comparing providers. Focusing on features such as insurance, security, pricing, proximity and access.

But with Highstreet Banks stopping this service, you might travel a few miles away from home, to get the box of your choice.

This guide will help you understand insurance, pricing, security features and access that meets your specific needs.

Contact us now to become confident in your safety deposit box choices

Choose the Right safety deposit box provider

To choose the right box, you need to begin by understanding your needs.

Are you a frequent user? A jeweller, who stores their original items in a safety deposit box. Might require frequent (no appointment) access.

Or are you storing your valuables for keepsakes? A newly wedded couple is storing their traditionally gifted jewellery as a keepsake. Might require less access.

In all, you want to store your valuables somewhere safe and secure. (See the safety and security features for areas to look out for).

Also, somewhere with excellent customer service. As your needs might change in the future. With marriage, kids and grandchildren, you may see the need to add someone you trust to your box.

Without good customer service, reflecting these changes in how you use your box, might be difficult.

Getting an insurance quote without putting these into consideration. Might invalidate your claim when you ever need one. As you may be getting more than your insurer is willing to risk on the box.

Understand the Requirements

Safety deposit centres are obligated to the FCA (Financial Conduct Authority). And are required to conduct AML (anti-money laundering) and ID checks on their customers.

You would be required two IDs: an address verification ID like a council tax letter, or utility bills. And a government-issued ID, like a driver’s license and or a passport.

Also, expect the centre to get an AML clearance on your behalf. All of which is completed within 10 minutes.

The step-by-step safety deposit box application process

It takes four steps to get a safety deposit box.

This step is curled by our current signup process at Stonewall Vaults

Step 1: Find a centre. Book an appointment and show up on your appointment day.

Step 2: On arrival, ring the video doorbell. Once you’re IDed, you will be admitted

Step 3: We verify your government-issued IDs, and proof of address and pass you through AML checks

Step 4: If (3) is successful, your biometric and handprint will be taken and registered to the box and security access systems.

These steps are similar to safety deposit centres across the UK.

Costs and fees associated with safety deposit boxes

On average you would look to spend from £150 to £660 per year for the basic fee.

Anticipate additional fees such as signup fees that can go from £30 to £50. Refundable key deposit fees that average around £30.

If you ever need to take out a safety deposit box insurance, you pay that directly to your broker. See our safety deposit box insurance guide for more details.

Accessing Your Safety Deposit Box

You would need to give your bank a 24-hour notice to access your box.

Independent providers, on the other hand, will not require prior notice. But will ID you each time you show up before admitting you into the centre.

Also, find out how easy it is to add someone to your box. This is important in the case of an emergency and as your situation changes.

If you require weekend access, find out from your centre about their weekend access policy. Stonewall Vaults is one of the few known centres with weekend and bank holiday access.

Safety and Security Features

Look out for these five safety deposit box security blind spots when renting a safety deposit box

The safety deposit box security:

The build and resistance grade of your safety deposit box is an important factor. Graded according to the European EN1143-1. The boxes range from 0 to 7. With 7 being the highest or longest it takes a burglar to break in or fire to destroy your valuables.

Safety deposit centre’s legitimacy:

Safety deposit centres must be registered with the FCA. Not all centres will display it on their websites. So, it’s worth asking. Also, find out what they require of you. Centres must conduct an AML check, and verify your address and ID.

Operational security:

How do people access the centre? Is there a system in place to effectively vet users before admitting them to the centre? The toughest centres combine electronic and physical security. Cutting-edge safety deposit box security solutions include video doorbells, handprints, strobe lights, smoke cloaks, fire extinguishing systems, panic alarms, CCTV surveillance, on-premises security guard (usually behind a ballistic glass) and priority police response.

Personal security:

Ensure: you don’t need employee assistance with your box (not the vault), there is no CCTV camera in the viewing rooms. If an employee has access, be sure your insurance covers employee theft as there could be a risk of employee theft. Safety deposit centres is a highly surveilled area. You are being watched 400ft from the centre by SIA-licensed security experts. And closely monitored while inside the vault. The only non-surveillance area is the viewing room. So, ensure your safety deposit centre has a private viewing room to protect your dignity.

Insurance:

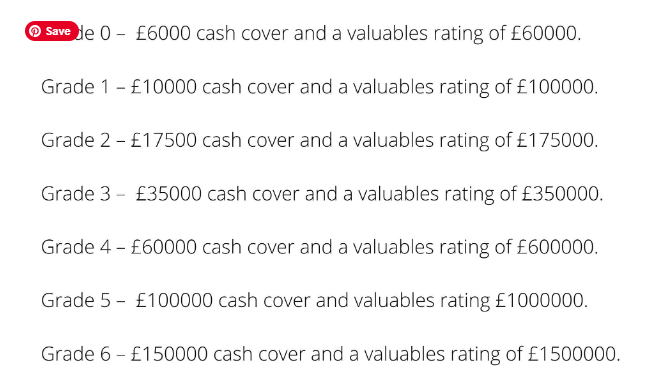

You need your insurance for additional protection. But ensure your valuable can be covered. Most providers have a maximum cover of £500,000. Confirm from your centre what the max cover is. So, you get your full payout if you ever need to make a claim. The screenshot below shows the maximum coverage by safety deposit box resistance grading.

Source: associated security

What is your preference?

Renting a safety deposit box is a simple 30 to 1-hour application process. It begins with finding your right fit centre following the guide we provided in this article.

Above all, ensure the centre is registered with the FCA. Eligible for insurance i.e. is EN1143-1 graded and has generous access that suits your needs.

The choice is yours. Do you require frequent access? Higher security and overall customer experience?

Be confident in your safety deposit box choice with Stonewall Vaults

Contact us now to get started